Probably every commercial landlord has already had an uncomfortable conversation with tenants about the rent that had to be paid for the coming quarter by April 1 at the latest. Various companies have requested an adjustment of the rent payment. Other tenants - such as AS Watson, for example - have informed landlords by letter that they will not comply with the payment obligation under the lease. Especially entrepreneurs in the retail and catering industry are seeing their turnover come to a halt overnight and have insufficient reserves to continue to pay significant costs such as rent.

On March 24, a “historic agreement” was concluded between representatives of tenants and landlords. This roughly meant that the rent payment could be suspended for 20 days and the rent could be paid in advance per month instead of per quarter. You can hardly call it papering over the cracks. It is clear that a real solution is needed: the break in our economy will continue for some time, but without income tenants simply cannot pay the rent. The Ministry of Economic Affairs is now mainly looking at “the market” to come up with a solution and to reach national agreements on rent deferment or rent reductions. Government intervention with an emergency law has not been excluded if the parties cannot reach a solution among themselves. However, situations vary so much that an industry-wide solution is inconceivable in the short term.

It is often thought that property owners will have paid for all those properties in cash and can easily miss a few months’ rent. However, most of the purchase amount is often financed with borrowed capital, so repayments and interest must be paid every month. Therefore, there is little room for deferment – let alone waiving the rent. As a landlord, do you simply have to stubbornly collect the rent and wait and see whether your tenant can survive and risk its bankruptcy? That idea does not work either. The gaps that will fall in the shopping streets will not be filled quickly. A long period of vacancy and lower rents are certainly not excluded. As a landlord you will also want to prevent your property becoming vacant. After all, there is nothing to repay without rental income. But suppose that landlords want to (or should) encounter massive problems with tenants and grant substantial rental concessions, this will have a negative effect on the value of real estate and can again lead to structural payment problems for landlords to their financiers.

A number of helpful landlords have offered to temporarily (partially) suspend the rental payment or convert it into a loan that must be repaid in a short period of time. The challenge here is that once the lockdown is gradually lifted, the turnovers are not immediately back to the old level. Then there is probably no room for a payment on top of the normal rent.

In order to prevent tenants who are viable in normal times and to preserve the value of investment properties, the tenant and landlord could also break open the contracts using the blend and extend method. A landlord can give a (temporary) rental discount or a rent-free period in exchange for a longer term on the agreement. Since commercial property is valued on a cash flow basis, the present value of the property can be upheld. This can be captured quite easily in a rider, without having to negotiate a whole new agreement.

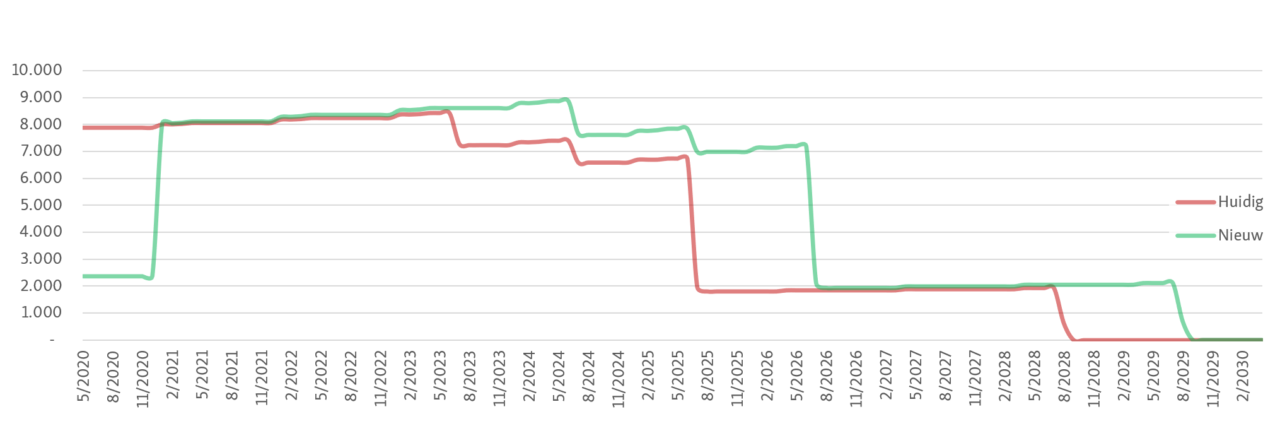

Once the tenant and landlord agree on the method, they will then have to agree on the payment schedule. To ensure that the present value of the rental flow remains the same, a discounted cash flow calculation is made of both scenarios whereby the present value remains the same as much as possible and at the same time creates some breathing space for the entrepreneur. In determining the new rental schedule there are all kinds of variables available, such as the period that the rent is lower, the extension period and the extent to which the rent periodically increases (indexation). In this way, something can be done to keep the entrepreneur afloat long term without it being the landlord who has to pay the majority of the bill. Most tenants will not even expect that. It is also not about unwillingness to pay but the powerlessness to pay. An additional effect is that only tenants with an urgent need will want to discuss this. Tenants who might otherwise make improper use of the situation will skip the conversation.

The landlord can also take this narrative to the bank. As long as the tenant is retained and the value of the loan collateral (i.e.: the rental agreement) does not disappear, there is perspective. The lockdown has also put commercial landlords in a difficult position. While they are having conversations with tenants, they must also ensure that they continue to meet the covenants with their lenders. It is therefore necessary to keep loan-to-value below the threshold required by the bank.

After the internet bubble and the financial crisis, the Corona crisis is of a completely different order: never before has a crisis led to an economic shutdown as we see now and this time no guilty parties can be identified, only victims. In the real estate sector, it requires all hands on deck to help entrepreneurs get through this misery. Let’s not forget that the rental flow is the lifeblood of this entire industry. If both tenants and landlords bear some of the pain and look for creative solutions together, we can get through this severe Corona winter together.

Redept has developed a calculation model that can be downloaded for free. We hope this contributes to a constructive dialogue between tenants and landlords.